Annual biometric transaction revenue will increase from $474 million in 2017 to $18 billion in 2022, exceeding a 100% CAGR. –Acuity Market Intelligence, 2017

Mobile smartphone has become a lifeline for professionals and the masses. Your communication, your financial transactions, your emotions all are being directed and controlled by this tiny supercomputer. With internet becoming faster and accessible to the general public the largest impact has been in the banking sector . Now the mobile based payments are witnessing a new change , with our smartphone becoming more intelligent biometric based payment authentication is gradually picking up and major investments are being put by financial sector in this direction.

Mobile phones are now extensively used by smart users in mobile commerce and payment services, on the fly transaction is helping user to do instant online purchase but security is still the major concern among the masses which kind of, is a major hindrance specially in the country like India. But Biometric based payment is the solutions which can win the user confidence of adopting online transaction that too using their smartphone. Having said that I would also like to say that

While biometrics are a strong security option, they are not 100% failproof. So multiple authentication system is still recommended

According to the recent study by Juniper Research

Mobile Biometrics to Authenticate $2 Trillion of Sales by 2023, Driven by Over 2,500% Growth in Remote Biometric Transactions

The research forecasts that the fastest growth will come from biometrically-verified remote mCommerce transactions, reaching over 48 billion in volume by 2023. This will be around 57% of all biometric transactions, up from an estimated 28% in 2018.

Before we further get into the depth of this new revolution, let me help you understand what is Biometric based secure Payment.

What Is Biometric Based Mobile Payment ?

This Payment mechanism employs your biological traits (physiological and behavioral) which are unique for every single human being , analyze it using the inherent characteristics that differentiate one individual from another. fingerprint, facial features or DNA are some of the ways to do it.

Biometrics refers to an authentication method known as Biometric identification which authenticates secure entry to data through human biology for information assurance (IA). This biometric field is divided into two main facets — physical assets and behavioral characteristics.

Behavioral Biometrics:

Is also being used which include voice, keystroke patterns, body language and other intangible traits. Motorola was the first smartphone manufacturer to bring this feature in its flagship mobile phone.

Apple and Samsung followed with the launch of iPhone 5S and Galaxy S5 with fingerprint scan embedded within the phone’s hardware

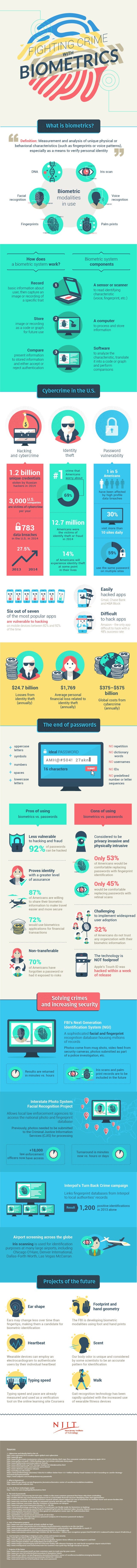

Let understand it more by this amazing compilation by njit

What Research Firms Are Saying About Biometric Enabled Mobile Payment?

According to a new report from Acuity Market Intelligence.

In 2022, more than 5.5 billion biometrically-enabled mobile devices will be in use, creating a global platform for these payments, the report noted.

Juniper Research Predicts:

that nearly 90% of smartphones currently in use can support software-based facial recognition, while 80% are capable of voice-based payments. Juniper believes that these services, as well as tracking user behavior, will enable secure cloud-based identity checks that are cross-platform and authenticate in the background. The research forecasts over 1.5 billion smartphones to use software-based biometrics by 2023

ref :